XME Pay: redefining an m-payments ecosystem

XME Pay: redefining an m-payments ecosystem Intesa Sanpaolo bank Share The human-centered approach is now central to the finance industry, as banks have become savvy in how to best connect to their customers’ needs and desires. As part of this trend, Intesa Sanpaolo asked Experientia to collaborate in the ideation and development of innovative features for a payment app (XME Pay). 3 things to know A step forward for digital and mobile payments The app is designed to be simple and immediately usable by a wide range of users. It also provides new services and functionalities, to improve on existing solutions. Working in agile mode To make development faster, we experimented with hybrid modes of prototyping, UX/UI design and agile methodologies. This helped ensure an efficient process and technically feasible solutions: concepts translate insights into actionable innovation opportunities to be prioritized, prototyped and evaluated. They took the form of platform or service visualizations, product design sketches, feature ideas, interaction and user interface solutions. Ongoing checks with service users To speed up the process of prototype testing and design iterations, we carried out several test rounds (with young users, seniors, professionals and families). Gallery In depth Service mix: Prototyping Information architecture User experience testing Behavioral modeling Useful links: Link to XME Pay Service by ISP Context Mobile and contactless payments continue to grow at an astonishing rate in Italy. In this context, Intesa Sanpaolo needed to quickly develop an effective mobile solution, able to compete both with the solutions provided by the main market players (Apple, Google) and with new innovative local players (SatisPay). Challenge Experientia was asked for a support during the contextual research, the definition of service concepts and prototypes, and the usability tests. Research Experientia conducted 16 contextual interviews in Milan and Naples, 10 with end-users and 6 with merchants. The interviews allowed us to identify payment behaviors and routines, and to generate ideas for accessory services such as discount management and loyalty cards. Design The study of the concept features was fundamental in the definition of the first and subsequent prototypes. Working in Agile, it was possible to quickly carry out several iterations of the application, and to test the functions with users in special sessions: some were dedicated to usability testing (training evaluation), others to specific insights, with different solutions in comparison (A/B testing). Impact The final solution was then developed and released in the summer of 2018, and was adopted in the first six months by 1.2 million customers (18% of the bank’s multi-channel customers). Link to XME Pay Service by ISP Related projects All Services Behavioral design Research and assessment Strategy Finance Banca 5, a new branchless bank model Consumer technologyFinance BancoSmart, an award-winning ATM Finance CSA: sentiment-based decision support platform for crypto-currency trading Go back to our portfolio

XME Salute: integrating insurance offerings with wellness and health practices

XME Salute: integrating insurance offerings with wellness and health practices Intesa Sanpaolo bank Share Analysis of the areas of overlap between welfare practices and insurance offering, up to the realization of a banking product able to enhance them both. 3 things to know Redefine the meaning of “insurance product” Research results allowed us to identify behavioral patterns regarding the attribution of value and meaning in health and wellbeing areas, and define hypothetical use scenarios on how to involve users in a holistic self-care. Facilitating and enabling behavioral change Based on an analysis of the offer and on the formative evaluation, we were able to create a better definition of the service model and a detailing of pre-requirements to convey this service through digital/web and mobile platforms. Drivers of behavioral change We analyzed drivers of behavioral change such as Environmental & Life Constraints, Motivation and Belief, Social Pressure and Constraints, Cultural Frameworks, and Architectural and Interface Affordances. Gallery In depth Service mix: Prototyping Information architecture User experience testing Behavioral modeling Useful links: Link to XME Salute Service by ISP Context Since the middle of the last decade, the phenomenon of private healthcare insurance in Italy has increased regularly: in 2016, 10 million Italians declared that they had private healthcare insurance, and the reason for the choice is due to a fundamental reason that prevails over everything else: the length of waiting lists (72.6%). To deal with a context in which users give up medical treatment because it is too expensive, Intesa Sanpaolo has launched an innovative service, able to integrate wellness practices (e.g. improving nutrition, sleep, …) with easy access to a network of clinics in which to book online medical examinations, diagnostic tests, dental and physiotherapy services. Challenge The Intesa Sanpaolo Innovation Center turned to Experientia for ongoing support in defining value propositions for its new set of services, called XME Salute (“Health 4 me”). We investigated behaviours, values and convictions people have on themes such as wellness, health and their relation with insurance products. Research Research results allowed us to identify some behavioral patterns regarding the attribution of value and meaning among health and wellbeing areas, enabling us to create hypothetical use scenarios to understand how to involve users in a holistic self-care. We analyzed drivers of behavioral change such as Environmental & life constraints, Motivation and belief, Social pressure and constraints, Cultural framework, Architectural and interface affordances. Design Based on the offer and the formative evaluation, we were able to better define the service model and detail some pre-requirements in order to convey this service through digital/web and mobile platforms. Impact Health services are an important testbed for the cultural change required by digital, so it is essential that the service model provided remains consistent with the initial design: for this reason, since the launch of the service (June 2019) we have continued to follow the evolution of features in order to keep them consistent with the service model. Link to XME Salute Service by ISP Related projects All Services Behavioral design Research and assessment Strategy Consumer technology Buttonless: engaging users in interactions with keyless devices B2B Collaboration UI, redesigning the filter navigation experience Cities & InfrastructureSocial innovation ToNite: social innovation and urban regeneration in Turin, Italy Go back to our portfolio

CSA: sentiment-based decision support platform for crypto-currency trading

CSA, Sentiment-based decision support Platform for crypto-currency trading EIT Digital, European Research Project Share As a partner of the CSA-Crypto Sentiment Advisor (an EIT research project), Experientia co-designed a web-based dashboard to inform better decisions in the crypto market. Leveraging traders’ individual level of expertise, the solution aims to mitigate risk by using real-time community sentiment data. 3 things to know Understand the habits of cryptotraders By interviewing cryptotrading experts and cryptotraders with different levels of experience, we were able to understand their habits, their sources of information, and the web platforms currently most used by those who invest in cryptocurrencies. Define the value proposition Using co-design methodology we worked with other project partners to identify a USP and the platform’s MVP: a dashboard to inform better decisions in the crypto market by using real-time community sentiment data. Design and validate the MVP solution Based on the results of the research and the co-design work done with the project partners, we designed the UX/UI of the platform, validated it with user interviews, and defined web development specifications. Gallery In depth Service mix: Design thinking Prototyping Information architecture Participatory design Ethnography Context As a partner of the CSA-Crypto Sentiment Advisor (an EIT research project), Experientia co-designed a web-based dashboard to inform better decisions in the crypto market. Leveraging traders’ individual level of expertise, the solution aims to mitigate risk by using real-time community sentiment data. Challenge The platform is based on a sentiment analysis model for cryptocurrency using advanced machine learning methods. Investors can use the signals to manage volatile phases of their portfolio to be well positioned in difficult times. During the research phase, Experientia conducted research interviews with lead users and led co-design activities with project partners to identify the Value proposition and the MVP functionalities. In the design phase, we designed the dashboard prototype and validated it with potential users. Research During the “early bird period” November-December 2020 Experientia research team conducted remote stakeholder interviews. The in-depth interviews allowed us to investigate the research question from a broad, comprehensive perspective. The main objective of the research was to investigate and identify opportunities for helping cryptotraders with sentiment-analysis tool. Model At the beginning of 2021 Experientia conducted 2 workshop with all the partners. We shared insights from the stakeholders and user research phase to inform and define the value proposition. Through participatory and co-design methodologies we facilitated the development of the next phases as well as conducted UX concept ideation activities. Design Experientia utilized findings from research to frame and define solutions for the design phase. In particular we design and validate the HI-fi prototype of the Sentiment-based decision support Platform for crypto-trading. Related projects All Services Behavioral design Research and assessment Strategy Finance Banca 5, a new branchless bank model Consumer technologyFinance BancoSmart, an award-winning ATM FinanceHealth XME Salute: integrating insurance offerings with wellness and health practices Go back to our portfolio

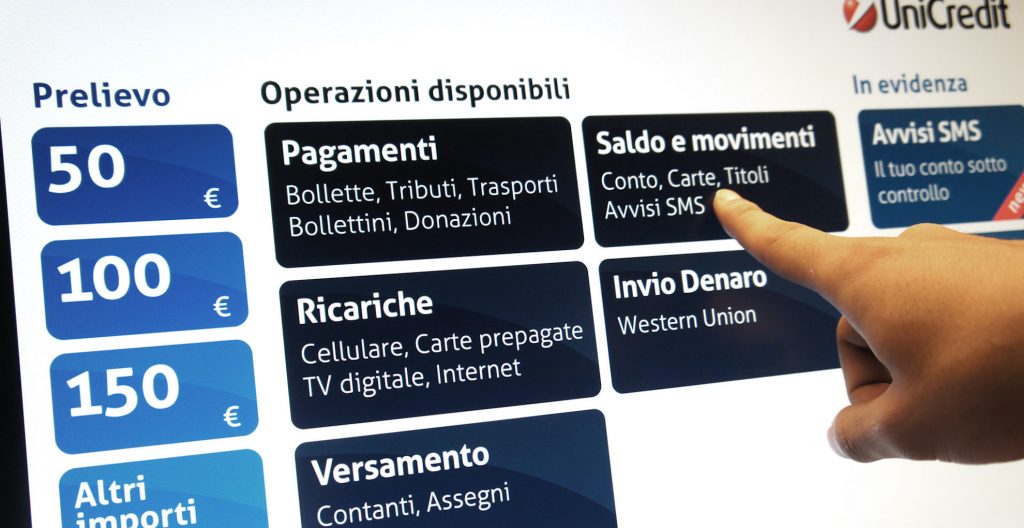

BancoSmart, an award-winning ATM

BancoSmart, an award-winning ATM UniCredit Share The human-centered approach is now central to the finance industry, as banks have become savvy in how to best connect to their customers’ needs and desires. As part of this trend, global banking and financial services company UniCredit Bank asked Experientia to create a user-friendly, people-centered ATM – the BancoSmart. 3 things to know Easier and faster The BancoSmart offers more services by using an advanced algorithm that offers users a personalized home page, geo-referenced billing options and tailored services. Improved usability Its UI makes it easier and more intuitive to use, including for people with poor vision; all levels of literacy and non Italian speakers. It is 33% faster in use, has attracted more than 25% of new (non UniCredit) customers, and reduced error rates (non-conclusive interactions) to less than 1%. First mover in Italy First Italian ATM using a touchscreen interface, allowing intelligent and optimized menu interactions. It has been rolled out all across the country. Gallery Video https://player.vimeo.com/video/110351007 In depth Service mix: Design thinking Information architecture Service design Useful links: ADI index showcase Blog post Context ATMs are highly regulated in Italy: to make banking accessible they have to provide a wide range of services, including the payment of various utilities. Many ATM interfaces are not user-friendly and force people to wade through a succession of many screens. They use a language and an organization that reflects the bank, rather than the lived financial experience of the customer. Challenge UniCredit came to Experientia to refresh and redesign the interface. It had to run on various ATM hardwares including legacy terminals of different providers with various screen sizes and tech specifications. We convinced the bank that it could be reinvented, even within the constraints of regulation, hardware and underlying software. Research Experientia carried out in-depth user experience research with ATM users across Italy, spot interviews of current ATM users, stakeholder interviews, card sorting sessions and heuristic evaluation of existing UniCredit and competitor interfaces. This provided foundation for the information architecture and service design of the ATM.We also conducted card sorting activities to create a new navigation structure that fits people’s expectations of where to find features and functions. Design Experientia designed a responsive full touchscreen design solution that works on the various ATM’s. We ran multiple cycles of design, prototyping and usability & user acceptance testing to ensure that the final interface is strongly based on people’s financial behaviors and exceeds their expectations and needs for ATM use. The new menu structure offers much clearer guidance on what functions are found in each menu area, and always offers people the chance to go back to the home page. It has now been rolled out to all UniCredit’s Italian ATM branches. Impact Experientia has reinvented the ATM interface for UniCredit – making it easier to use, faster, and with more services. One of the key innovations is its level of personalization – the ATM has a personalized homepage, with service offers tailored to people’s banking profiles, and a speedy withdrawal function that offers the three most commonly used withdrawal amounts, personalized to each individual user based on their past behavior. Placing these three amounts on the homepage cut the withdrawal time by 30%. Public reactions to the BancoSmart interface have been extremely positive, with clients commenting on the increased speed, legibility, appealing graphics, and the improvement in features and functions. The highly intuitive ATM interaction allows clients to easily navigate, locate and use functions, from simple features like cash withdrawals to more complicated functions like deposits, information retrieval, bill payments and mobile phone top-ups. The interface is visually attractive and easy to read, with large fonts and clear banking function categories. Bancosmart was selected for the ADI Design Index, the annual publication showcasing select Italian Design products considered for the Compasso d’Oro International Award. View our ADI Design Index showcase here. ADI index showcase Blog post Related projects All Services Behavioral design Research and assessment Strategy Finance Banca 5, a new branchless bank model Finance CSA: sentiment-based decision support platform for crypto-currency trading FinanceHealth XME Salute: integrating insurance offerings with wellness and health practices Go back to our portfolio

Banca 5, a new branchless bank model

Banca5, a new branchless bank model Intesa Sanpaolo bank Share Experientia conducted an analysis of everyday transactions in the tobacconist’s shop, and defined interfaces and processes for a new Point of Service (POS). 3 things to know When digital banking is not sufficient The main problem that big banks have today is to allow non-digital customers (by age, education, internet access, …) to easily access the simplest banking services. Taking the branch out of the branch The aim of the project was to facilitate interaction with a manager outside the context of a branch. To do so, the main features of the banking network (sense of trust and protection, problem-solving capacity) need to be kept outside the bank. A non-invasive solution In parallel, we proposed a solution to the tobacconist network that is easy to learn and use, able to reduce the time of individual operations, and minimize the error ratio. In this way, the solution was accepted by the network and was immediately used. Gallery In depth Service mix: Information architecture Ethnography Context In the last ten years, about a third of bank branches in Italy have been closed. Banks have leveraged the new opportunities provided by technology, but for some sections of the population or in special cases computers and smartphones are not enough. Banca5 was created on the initiative of Intesa Sanpaolo to meet all customers who need to interact with a person to carry out simple operations (such as payments): distributed over a network of about 15,000 tobacconists, it allows the bank’s customers to carry out operations without going to the branch. Tobacconist shops in Italy do not only provide tobacco products in various forms, but also public transport tickets, lottery products, mobile phone top-ups, utilities bill payments, and stationery. In some cases they also have a bar. Challenge In 2019, Banca5 planned to upgrade POS terminals with screen and keyboard to an Android SmartPOS model the size of a phone. To make the transition effective, Experientia was involved as interaction design experts in the research and definition of the new user experience. We conducted a research on Banca5’s existing devices and analyzed the use routines of tobacconists, in order to highlight painpoints and requirements, also compared to the terminals of the competition (Lottomatica and Sisal). Research The observations at the tobacconist shop were functional to redefine the terminal’s UX (flow and information architecture) and to intercept aspects of the tobacconist’s experience. It allowed us to define priorities and needs useful for pursuing the Bank’s strategic objectives. Design TWe supported Banca5 in the complete redesign of the new device : the project was conducted in three iterations of prototyping and testing (all in Agile), in order to verify the solution with users as it was implemented. Impact The new terminal was launched in mid-2019 and was quickly adopted by some 2,000 tobacconists: intensive work and testing allowed POS interactions to be effectively transferred to a five-inch screen, minimizing error-rate and further speeding up the way tobacconists work. Related projects All Services Behavioral design Research and assessment Strategy Consumer technologyFinance BancoSmart, an award-winning ATM Finance CSA: sentiment-based decision support platform for crypto-currency trading FinanceHealth XME Salute: integrating insurance offerings with wellness and health practices Go back to our portfolio